Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

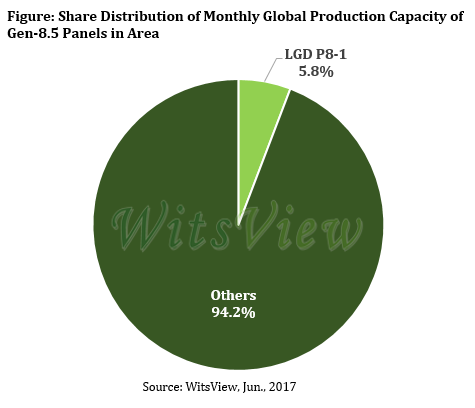

LG Display (LGD) suffered a serious disruption to its production of large-size LCD panels on June 24, when a deadly accident occurred at its P8-1 panel fab in Paju, South Korea. The Gen-8.5 has been shut down for repair and investigation by the local authorities. WitsView, a division of TrendForce, states that this incident will have a major impact on the supply of large-size panels in the third quarter. While panel quotes have softened during the second quarter, the third quarter will see a return of seasonal demand from device vendors. The accident at P8-1 will contribute to a tightening of the supply and help prop up prices to some extent.

To have P8-1 resume operation after the investigation and repair will take two weeks to a month. During this interim period, LGD’s monthly production capacity for large-size panels in area is estimated to be cut down by 715,000 square meters. This loss of production capacity in turn will affect the supply situation in the third quarter.

WitsView’s analysis model initially estimated that the glut ratio of large-size panel market for this third quarter will be 4%. The shutdown of P8-1 has led to a downward revision. If the fab is closed for two weeks, then the projected glut ratio will drop to 3.4%. A four-week closure will further lower the figure down to 2.8%. On the whole, the supply in the third quarter will be tighter than initially anticipated. Furthermore, prices of panels of certain sizes (e.g. the 55-inch) will regain stability after experiencing a gradual slide in the second quarter.

For device vendors, the accident at P8-1 is too sudden for them to make adjustments in their panel purchases and product mixes. LGD’s compatriot and Japanese clients will bear the brunt of the supply disruption, while some orders will be shifted to Samsung Display (SDC) and BOE Technology (BOE). As for Taiwanese panel makers, their ability to take advantage of this situation is also limited because their product mixes are very different from LGD’s. Nonetheless, WitsView believes that the loss of production capacity will cause orders to be rerouted and increase the aggressiveness of stock up activities during the busy season of the third quarter. Therefore, the entire panel industry will benefit from the strengthening of the demand.

Subject

Related Articles

Related Reports